In an era where financial crimes are becoming more sophisticated, the demand for skilled fraud examiners has never been greater. The Certified Fraud Examiner (CFE) credential stands as a global benchmark for integrity, expertise, and investigative excellence. Earning it not only demonstrates your ability to detect, prevent, and deter fraud but also positions you among the most trusted professionals in the financial and compliance sectors.

However, preparing for the CFE Exam can be challenging without the right strategy and up-to-date guidance. With the 2025 updates to exam content and structure, it’s crucial to approach your preparation with clarity and focus. This Certified Fraud Examiner Exam Study Guide – Updated 2025 provides a comprehensive roadmap, covering the latest domains, key topics, study techniques, and expert insights that will help you master the material and succeed on your first attempt. If you are serious about advancing your career in fraud prevention, risk management, or compliance, this guide will equip you with the direction and confidence needed to achieve your CFE certification.

What Is the Certified Fraud Examiner (CFE) Credential?

The Certified Fraud Examiner (CFE) designation is awarded by the Association of Certified Fraud Examiners (ACFE), the world’s largest anti-fraud organization. It signifies proven expertise in fraud prevention, detection, and investigation. CFEs are trained to understand complex financial transactions, identify warning signs of fraud, and implement measures to prevent it.

The credential is globally recognized across industries such as banking, auditing, corporate governance, law enforcement, and risk management. Holding a CFE not only enhances your credibility but can also open doors to leadership positions in compliance and forensic accounting.

The Certified Fraud Examiner (CFE) exam is a professional certification exam offered by the Association of Certified Fraud Examiners (ACFE). The exam tests candidates’ knowledge and skills in the field of fraud examination and prevention, including areas such as financial transactions, fraud schemes, investigation techniques, and legal considerations. It is designed to validate the expertise of fraud examiners and is widely recognized in the industry.

Eligibility Criteria

To qualify for the CFE Exam, candidates must:

- Hold a bachelor’s degree (any discipline) or equivalent professional experience.

- Have at least two years of professional experience in a field related to fraud detection or deterrence (e.g., auditing, law enforcement, accounting, loss prevention).

- Be a member of the ACFE before applying for the exam.

Exam Format:

- Mode: Online via the ACFE Exam Portal

- Questions: 100 per section (400 total)

- Duration: 2 hours per section

- Passing Score: 75% or higher in each section

Certified Fraud Examiner Exam Glossary

Here are some key terms related to the Certified Fraud Examiner (CFE) exam:

| Term | Definition |

|---|---|

| Accounting Anomaly | An irregular or inconsistent financial entry that may suggest manipulation, misstatement, or fraud. |

| Accrual Accounting | Accounting method that records revenues and expenses when earned or incurred, not when cash is received or paid. |

| ACFE (Association of Certified Fraud Examiners) | The global organization that administers the CFE credential and promotes anti-fraud education and standards. |

| Affirmative Defense | A legal argument where the defendant introduces evidence to negate liability, even if the allegations are true. |

| Asset Misappropriation | Theft or misuse of an organization’s resources, such as cash skimming, payroll fraud, or false billing. |

| Benchmarking | Comparing data or financial performance against standards or industry averages to detect anomalies. |

| Bribery | Offering or accepting something of value to influence the actions of a person in authority. |

| Bylaws | Internal organizational rules established by a board to govern management and operations. |

| Chain of Custody | The documented process that tracks the handling and storage of evidence to preserve its integrity. |

| Circumstantial Evidence | Indirect evidence that implies a fact without directly proving it, such as motive or opportunity. |

| Conflict of Interest | A situation where personal interests interfere with professional duties or loyalty to the organization. |

| Corruption | Abuse of power for personal gain, often involving bribery, extortion, or nepotism. |

| Corporate Governance | The framework of policies and controls that guide a company’s management and accountability. |

| Data Analytics | The process of examining datasets to identify fraud indicators, trends, or anomalies. |

| Direct Evidence | Evidence that directly proves a fact, such as an eyewitness statement or confession. |

| Due Diligence | The process of investigating potential investments or relationships to identify risks, including fraud. |

| Embezzlement | The misappropriation of funds entrusted to one’s care, often by an employee or agent. |

| Evidence | Any information, document, or testimony that helps prove or disprove a fact in an investigation or trial. |

| Expert Witness | A qualified individual who provides specialized knowledge to help a court understand technical matters. |

| False Statement | Knowingly providing incorrect or misleading information in a report or testimony. |

| Financial Statement Fraud | Deliberate misrepresentation of financial information to deceive stakeholders or regulators. |

| Fraud | Intentional deception for personal or financial gain that causes harm to another party. |

| Fraud Triangle | A model identifying three factors that lead to fraud: pressure, opportunity, and rationalization. |

| Grand Jury | A group that reviews evidence to determine if there’s sufficient cause for criminal charges. |

| Gratuity | A gift or payment given voluntarily, which may become a bribe if intended to influence decisions. |

| Horizontal Analysis | Comparing financial data across periods to identify changes or unusual trends. |

| Hearsay Evidence | Out-of-court statement presented to prove the truth of the matter—usually inadmissible. |

| Indictment | A formal charge issued by a grand jury to prosecute an individual for a criminal offense. |

| Insider Trading | Trading securities based on material, non-public information, which is illegal in most jurisdictions. |

| Internal Controls | Policies and procedures that safeguard assets, ensure accuracy, and prevent fraud or errors. |

| Interview | A structured conversation used to gather information, evidence, or admissions during an investigation. |

| Jurisdiction | The authority of a court or agency to hear and decide a legal case. |

| Kickback | An illegal payment made to reward favorable treatment or secure business advantages. |

| Lapping | Concealing theft by using one customer’s payment to cover the stolen payment of another. |

| Larceny | The unlawful taking of another’s property with intent to permanently deprive them of it. |

| Liability | Financial obligations or debts owed by a company or individual. |

| Mail Fraud | The use of postal services to carry out a fraudulent scheme, punishable under law. |

| Materiality | The importance of a transaction or error significant enough to influence financial decisions. |

| Money Laundering | Concealing the origin of illegally obtained funds through complex financial transactions. |

| Nepotism | Favoritism toward relatives or friends, often resulting in conflict of interest or unethical practices. |

| Net Worth Method | Technique for estimating unreported income by analyzing changes in a person’s assets and liabilities. |

| Occupational Fraud | Fraud committed by employees against their employers through theft or deception. |

| Opportunity | The ability to commit fraud without detection, often due to weak controls. |

| Perjury | Knowingly making false statements under oath in a legal proceeding. |

| Ponzi Scheme | Fraudulent investment operation paying returns to earlier investors with new investors’ funds. |

| Predicate Offense | An underlying crime that supports prosecution for another crime, such as money laundering. |

| Pressure | The financial or personal motivation that drives someone to commit fraud. |

| Questioned Document | A document whose authenticity or authorship is in dispute and requires forensic examination. |

| Rationalization | The internal justification a fraudster uses to make unethical behavior seem acceptable. |

| Red Flags | Warning signs or indicators suggesting possible fraud or irregularities. |

| Restitution | Court-ordered repayment made by an offender to compensate victims for financial loss. |

| Shell Company | An inactive or fake company created to hide ownership or move illicit funds. |

| Skimming | Stealing cash receipts before they are recorded in an organization’s accounting system. |

| Subpoena | A legal order requiring someone to appear in court or produce documents. |

| Testimonial Evidence | Information given under oath by a witness in court or during an investigation. |

| Tort | A civil wrong that causes harm or loss and may lead to legal liability. |

| Travel Fraud | Submitting inflated or false travel expense claims for reimbursement. |

| Undercover Operation | A covert investigation where an examiner assumes a false identity to detect fraud. |

| Unjust Enrichment | A legal principle preventing someone from profiting unfairly at another’s expense. |

| Vendor Fraud | Fraud involving suppliers, such as billing for goods not delivered or inflating prices. |

| Vicarious Liability | A legal concept holding one party responsible for the actions of another (e.g., employer liability). |

| Whistleblower | An employee or individual who reports unethical or fraudulent activities. |

| Wire Fraud | A scheme using electronic communication to commit fraud. |

| Working Papers | Documentation created by auditors or investigators to support their findings and conclusions. |

| Zero Tolerance Policy | A strict policy enforcing immediate action or punishment for any instance of fraud or misconduct. |

These are just a few of the many terms that may be relevant to the CFE exam.

Certified Fraud Examiner Exam Guide

Here are some official resources for the Certified Fraud Examiner (CFE) exam:

- Association of Certified Fraud Examiners (ACFE) website: The ACFE is the organization that administers the CFE exam. Their website includes information about the exam, study materials, and other resources for aspiring fraud examiners. https://www.acfe.com/

- CFE Exam Prep Course: The ACFE offers an online course that covers the topics on the CFE exam, including fraud prevention and deterrence, financial transactions and fraud schemes, investigation, and legal elements of fraud. https://www.acfe.com/training-center/cfe-exam-prep-course/

- Fraud Magazine: The ACFE’s Fraud Magazine is a publication that provides insights and updates on fraud-related topics, including case studies, interviews with fraud experts, and information about new trends and techniques in fraud prevention and detection. https://www.fraud-magazine.com/

- CFE Exam Study Community: The ACFE offers a study community for CFE exam candidates where they can connect with other aspiring fraud examiners, ask questions, and get study tips and advice from experienced CFEs. https://community.acfe.com/community/certifications/cfe-certification

- CFE Exam Review Course: The ACFE offers an in-person CFE Exam Review Course that provides intensive preparation for the exam and includes expert instruction, study materials, and sample exam questions. https://www.acfe.com/training-center/cfe-exam-review-course/

These resources can be helpful for anyone preparing for the CFE exam.

Certified Fraud Examiner Exam Tips and Tricks

Here are some tips and tricks for the Certified Fraud Examiner (CFE) Exam:

- Study the exam content outline: The CFE exam content outline is provided by the Association of Certified Fraud Examiners (ACFE) and includes the topics covered on the exam. Use this as a guide to structure your studying and ensure you cover all the necessary material.

- Use the ACFE resources: The ACFE offers study materials, including a Fraud Examiners Manual, practice exams, and online review courses. Utilize these resources to prepare for the exam.

- Practice with sample questions: The ACFE provides sample questions on their website to give you an idea of the types of questions that may be on the exam. This will help you become familiar with the format and structure of the exam.

- Understand the concepts: Don’t just memorize definitions and concepts. Make sure you understand how the different concepts are related and how they apply to real-world situations.

- Manage your time: The CFE exam consists of 125 multiple-choice questions and you have four hours to complete the exam. It’s important to manage your time effectively and make sure you don’t spend too much time on any one question.

- Take breaks: It’s important to take breaks during the exam to rest your mind and refocus. Take advantage of the scheduled breaks during the exam to stretch, take a walk, or have a snack.

- Stay calm and focused: Don’t let anxiety or stress get in the way of your success. Stay calm, focused, and confident throughout the exam.

Certified Fraud Examiner (CFE) Exam Study Guide

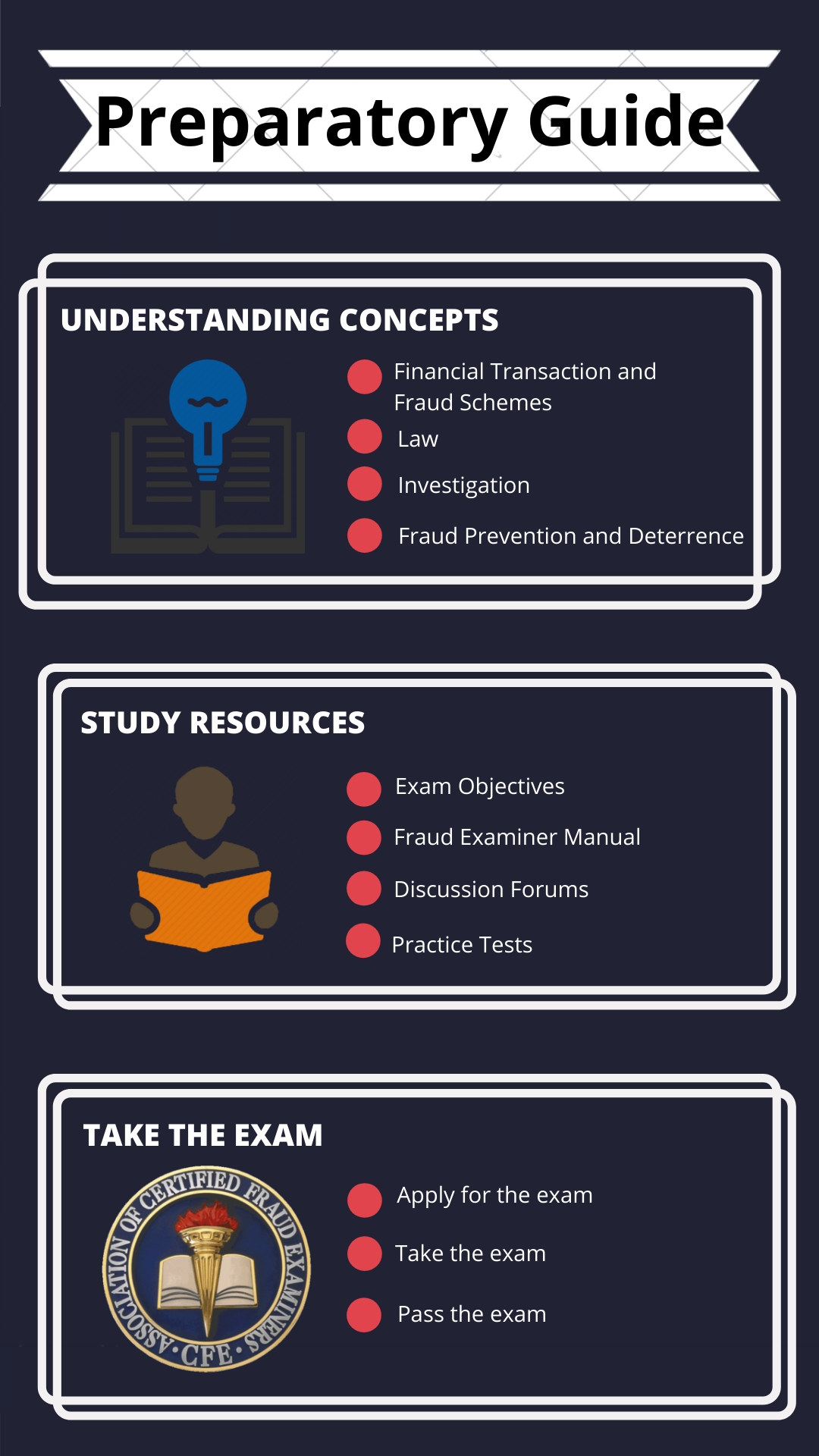

The Preparations for Certified Fraud Examiner exam is tough given its vast CFE syllabus. It is difficult to comprehend each and every concept. Being consistent with your preparations is the key. Hence follow the step-by-step study guide to ace the exam.

Step 1- Understanding the Exam Objectives

The objectives are the most necessary part for any exam like the Certified Fraud Examiner (CFE) exam. Having utmost clarity about the exam course is indeed essential. These course objectives act as a blueprint for your exam and boost your preparations. Therefore, you must visit the Official Exam Guide to learn more about the exam policies and concepts. The CFE exam sections consists of majorly four domain:

Domain 1 : Financial Transactions and Fraud Schemes

It tests the candidate’s comprehension of the varieties of fraudulent financial activities acquired in accounting records. To claim Financial Transactions & Fraud Schemes, you will be asked to illustrate knowledge of the subsequent concepts: fraud schemes, basic accounting and auditing theory, internal controls to prevent fraud, and additional accounting and auditing matters.

Domain 2: Law

This domain ensures the liberties with the various legal divisions of managing fraud examinations, including rules of evidence, criminal and civil law, rights of the challenged and accuser, and expert witness concerns.

Domain 3: Investigation

Further the Fraud investigation domain involves questions about taking statements, interviewing, collecting information from public records, investigating illicit transactions, and assessing deception and report writing.

Domain 4: Fraud Prevention and Deterrence

Lastly, this domain tests the candidate’s perception of why people engage in fraud and approaches to prevent it. Topics recounted in this section add white-collar crime, crime causation, occupational fraud, fraud risk assessment, fraud prevention, and the ACFE Code of Professional Ethics.

Step 2- Explore Study Resources

There are plenty of learning resources for the Certified Fraud Examiner exam available in the marketplace that provides unique CFE exam study material. Further, you must choose wisely and refer the ones that best suit your preparations. Here are some recommended study resources-

Fraud Examiner Manual

An outstanding reference guide to practice while exercising the Certified Fraud Examiner Exam Preparation Course is the Fraud Examiners Manual. The Fraud Examiners Manual, marked as the reference criterion for the anti-fraud education, is a complete guide fully describing the latest fraud examination systems, techniques, methods, and procedures. Also, you can download from the official page of the ACFE.

Discussion Forums

Joining discussion forums can be a great investment to prepare for the CFE exam. They help the aspirants to foster their preparation process. ACFE affiliates can visit the CFE Exam discussion conference to post problems online and receive feedback from other members and ACFE staff. However, the discussion forums remain in the Members Only section of ACFE.com.

Practice Tests

Practice tests are the most important as well as helping tools to prepare for the exam. They help you find out your core strengths and iron out your weaknesses. Strengthening these weaknesses improvises your preparations and expands your knowledge. Therefore, after preparation, we suggest you to try a hands-on practice test. Moreover, attempting Multiple Practice Tests helps in boosting your confidence. Start using CFE Exam Sample Questions for Practice Now!

How to Prepare for the Certified Fraud Examiner (CFE) Exam? (Updated 2025)

Preparing for the CFE Exam requires more than just reading through manuals; it demands strategy, consistency, and smart study planning. The exam covers four distinct domains—Fraud Prevention and Deterrence, Financial Transactions and Fraud Schemes, Investigation, and Law, each testing your analytical thinking and ability to apply fraud examination principles in real-world contexts.

1. Understand the Exam Structure and Content

Start by familiarizing yourself with the exam blueprint provided by the Association of Certified Fraud Examiners (ACFE). Each section carries equal weight (100 questions per domain), and the exam tests both conceptual knowledge and application. Understanding what’s expected helps you prioritize your study time wisely.

- Fraud Prevention and Deterrence: Focus on ethics, corporate governance, fraud risk assessment, and criminology theories.

- Financial Transactions and Fraud Schemes: Review accounting fundamentals, financial statement fraud, and various occupational fraud schemes.

- Investigation: Master interview techniques, evidence handling, digital forensics, and analytical procedures.

- Law: Study criminal and civil law principles, legal rights, evidence rules, and the litigation process.

2. Build a Realistic Study Timeline

The CFE exam is best approached with a consistent schedule over 8–10 weeks. Break your preparation into smaller, manageable daily goals. Devote more time to areas outside your professional background, for instance, accountants may need more focus on the legal domain, while investigators might require extra time for financial concepts.

3. Use the Official ACFE Prep Materials

The ACFE CFE Exam Prep Course is the most reliable resource—it includes digital study guides, practice questions, progress tracking, and updated material aligned with 2025 exam changes. Pair it with:

- CFE Exam Study Manual (2025 Edition) for in-depth reading

- Fraud Examiners Manual for case studies and real-world applications

- ACFE Practice Questions to simulate the test environment

4. Study Actively, Not Passively

Instead of simply reading chapters, engage with the content:

- Take handwritten notes to strengthen memory retention.

- Summarize complex topics like fraud schemes or evidence handling in your own words.

- Use flashcards for quick recall of legal definitions and fraud terms.

- Discuss tricky questions in ACFE study groups or LinkedIn communities.

5. Take Practice Exams Regularly

Simulate test conditions early. Take a mock exam after every domain to assess comprehension and timing. The goal isn’t just to score high, but to identify weak areas and refine your strategy.

- Review incorrect answers carefully.

- Note patterns in your mistakes (e.g., rushing through legal scenarios or missing subtle accounting cues).

- Revisit the corresponding sections in the manual or prep course.

6. Focus on Conceptual Clarity and Application

The CFE exam emphasizes application over memorization. You must be able to apply principles—for example, identifying the correct fraud prevention measure for a given scenario, or recognizing the right legal step in an investigation.

To strengthen conceptual understanding:

- Study case studies from ACFE materials.

- Relate exam content to your own professional experiences.

- Use mnemonics and scenario mapping to connect theory with practice.

7. Revise Strategically Before the Exam

Reserve the final two weeks for revision and consolidation.

- Review notes, flashcards, and difficult topics daily.

- Take two full-length mock exams under timed conditions.

- Focus on improving speed, accuracy, and question interpretation.

Keep a light review schedule the day before the exam avoid cramming. Rest well and approach test day with a clear mind.

CFE Exam Preparation Plan (8-Week Structured Table)

| Week | Focus Area | Key Activities | Goals for the Week |

|---|---|---|---|

| Week 1 | Orientation & Planning | • Review CFE Exam structure and ACFE candidate handbook • Join ACFE community or online study group • Gather study materials (Prep Course, Manuals, Notes) | Understand the exam format and create a personalized study calendar |

| Week 2 | Fraud Prevention & Deterrence | • Study fraud risk management, corporate governance, and ethics • Review fraud theories and deterrence strategies • Attempt topic-based quizzes | Build a foundation on fraud principles and prevention frameworks |

| Week 3 | Financial Transactions & Fraud Schemes (Part 1) | • Cover accounting basics and key financial ratios • Study asset misappropriation, corruption, and financial statement fraud • Practice numerical questions | Strengthen accounting and fraud detection concepts |

| Week 4 | Financial Transactions & Fraud Schemes (Part 2) | • Review CFE Exam structure and ACFE candidate handbook • Join the ACFE community or online study group • Gather study materials (Prep Course, Manuals, Notes) | Gain confidence in financial fraud detection and analysis |

| Week 5 | Investigation | • Study interview techniques, evidence collection, and data analysis • Review digital forensics basics • Practice case-based questions | Learn to apply investigation principles to real-world scenarios |

| Week 6 | Law | • Cover legal terminology, criminal vs. civil law, and rules of evidence • Understand the prosecution process and the rights of the accused • Attempt legal scenario-based quizzes | Build accuracy in interpreting legal situations |

| Week 7 | Mock Exams & Weak Area Review | • Attempt one full-length practice test per domain • Analyze results and focus on weak areas • Revise key formulas, definitions, and laws | Improve performance through targeted review |

| Week 8 | Final Revision & Exam Readiness | • Revisit all notes and key concepts • Take one full-length simulated CFE exam • Focus on mental preparation and time management | Ensure readiness and confidence for the actual exam |

Final Tips for Success

- Stay consistent: Study a little every day rather than cramming.

- Balance your time: Spend equal effort on understanding, practice, and revision.

- Prioritize weak areas: Don’t over-study what you already know.

- Use active recall: Quiz yourself often—it’s far more effective than passive reading.

- Rest and recharge: Maintain good sleep and stress management during preparation.

Elevate your skills and advance your knowledge by qualifying the Certified Fraud Examiner exam. Start your Preparations Now!