The ACAMS (Association of Certified Anti-Money Laundering Specialists) certification, also known as the CAMS credential, is globally recognized as the gold standard for professionals in anti-money laundering (AML) and financial crime prevention. Designed for compliance officers, auditors, investigators, and risk management professionals, this certification validates your ability to detect, prevent, and respond to financial crime threats. Earning the CAMS credential not only strengthens your professional credibility but also enhances your marketability across banks, fintech companies, regulators, and law enforcement agencies. It’s a trusted benchmark for employers looking for individuals who can uphold the highest standards of compliance in a rapidly evolving regulatory environment.

How does the CAMS Certification help advance your career?

Whether you’re beginning your career in AML or looking to move up the ladder, the CAMS certification provides a competitive edge. It equips you with in-depth knowledge of risk assessment, transaction monitoring, regulatory frameworks, and investigative techniques. Certified professionals often gain access to better job opportunities, leadership roles, and international assignments. Additionally, CAMS membership connects you to a powerful global network of compliance professionals, continuous learning resources, and exclusive career development tools.

Beyond technical knowledge, the CAMS certification opens doors to tangible career growth. Certified professionals are often fast-tracked for promotions, offered leadership roles, or chosen for specialized assignments across global compliance teams. In a competitive job market, having CAMS on your resume can set you apart from other candidates, especially in highly regulated industries like banking, fintech, insurance, and investment services.

Moreover, becoming a part of the ACAMS community gives you access to an influential network of professionals, industry leaders, and mentors across the globe. You gain exclusive access to webinars, whitepapers, job boards, regional chapters, and continuing education opportunities that keep you at the forefront of compliance and financial crime trends. For those looking to stay agile, informed, and relevant in a rapidly changing landscape, CAMS is more than a certification— it’s a launchpad for a long-term, impactful career in compliance.

Exam Fees

ACAMS certification is valuable for people working against financial crime because it shows they know a lot about stopping bad money activities. These certifications are known worldwide and bosses in banks and financial services really like them. They’re important for industries that can be targets for money-related crimes. ACAMS certification helps professionals learn how to spot and stop bad money activities, like money laundering and terrorism funding. These certifications teach about risks, rules, investigations, and new trends in financial crime.

Now that you know what CAMS can do for your career, let’s talk numbers. The total cost of obtaining the ACAMS certification typically falls between $1,695 and $1,895, depending on your region and whether you’re an ACAMS member. This fee usually includes access to the study guide, e-learning resources, and one exam attempt. ACAMS membership, which can offer discounted exam pricing, costs an additional $125 to $295 annually. Candidates can also opt for supplementary materials like virtual classes, flashcards, and practice exams for an extra fee. While it’s a notable investment, the long-term benefits—such as increased salary potential, career advancement, and global recognition, make the ACAMS certification a smart and strategic choice for compliance professionals.

The exam fees for ACAMS certifications vary depending on the specific certification and the location of the exam. Here is a breakdown of the exam fees for the most popular ACAMS certifications:

- Certified Anti-Money Laundering Specialist (CAMS): The exam fee for the CAMS certification is $1,199 for ACAMS members and $1,499 for non-members.

- Next, Certified Global Sanctions Specialist (CGSS): The exam fee for the CGSS certification is $695 for ACAMS members and $895 for non-members.

- Certified Financial Crime Specialist (CFCS): The exam fee for the CFCS certification is $475 for ACAMS members and $675 for non-members.

It is important to note that there may be additional fees associated with the certification process, such as application fees and study materials. These costs can vary depending on the individual and their specific needs. ACAMS also offers discounts and promotions throughout the year, so it is recommended to check their website for current pricing and special offers. Moreover, some companies might pay for your certification, so it’s a good idea to ask your employer before you decide to pay for it yourself.

Recertification Fees

ACAMS requires that certified individuals recertify every two years in order to maintain their certification. The recertification process includes continuing education credits, work experience, and payment of a recertification fee. The recertification fee varies depending on the specific certification and whether the individual is a member of ACAMS. Here is a breakdown of the recertification fees for the most popular ACAMS certifications:

- Certified Anti-Money Laundering Specialist (CAMS): The recertification fee for the CAMS certification is $150 for ACAMS members and $250 for non-members.

- Next, Certified Global Sanctions Specialist (CGSS): The recertification fee for the CGSS certification is $75 for ACAMS members and $150 for non-members.

- Certified Financial Crime Specialist (CFCS): The recertification fee for the CFCS certification is $75 for ACAMS members and $150 for non-members.

It is important to note that there may be additional fees associated with the recertification process, such as continuing education courses or conferences. These costs can vary depending on the individual and their specific needs.

ACAMS also offers discounts and promotions for recertification, so it is recommended to check their website for current pricing and special offers. Additionally, some employers may cover the cost of recertification for their employees, so it may be worth checking with your employer before paying for the recertification fee yourself.

Cost Comparison

There are various AML certifications out there, and the certification cost can differ greatly based on the certifying organization and where you take the exam. Let’s compare the ACAMS certification cost with some other well-known AML certifications:

- Association of Certified Fraud Examiners (ACFE): The Certified Fraud Examiner (CFE) certification offered by ACFE costs $300 for the exam and $100 for the application fee. The recertification fee is $195 for members and $245 for non-members.

- International Compliance Association (ICA): The International Diploma in Anti Money Laundering (AML) certification offered by ICA costs around $3,100 for the course, exam and certificate.

- American Bankers Association (ABA): The Certified AML and Fraud Professional (CAFP) certification offered by ABA costs $995 for the exam and study materials. The recertification fee is $295 for members and $395 for non-members.

Compared to these other certifications, the ACAMS certification can be consider relatively more expensive, especially for the initial exam. However, ACAMS is considered the industry standard in AML certification and is recognized globally, which can be an advantage for professionals seeking career advancement and opportunities.

It is important to research and compare different AML certifications to determine which one is best suited for an individual’s career goals and budget.

Exam pattern

Money laundering and terrorist funding strategies will be include on the CAMS exam. However, you may come across these topics in the context of the non-bank financial system. These include casinos and insurance companies, as well as current terrorist financing strategies. Concerns about compliance arrangements will also centre on risk models, evaluations, and procedural policies.

Candidates will also be ask about best practises, internal controls, and continuing training when it comes to managing compliance programmes. In addition, there are portions on investigation methods and national and international anti-money laundering regulations in the supplementary test sections. As a result, make sure you’re well-versed in all of the above-mentioned areas. However, if you’re still unsure where to obtain the CAMS examination’s comprehensive course outline, We’ve got you covered, so don’t worry. The CAMS exam course outline will be discuss in the following sections. So please stick with us.

Course Outline

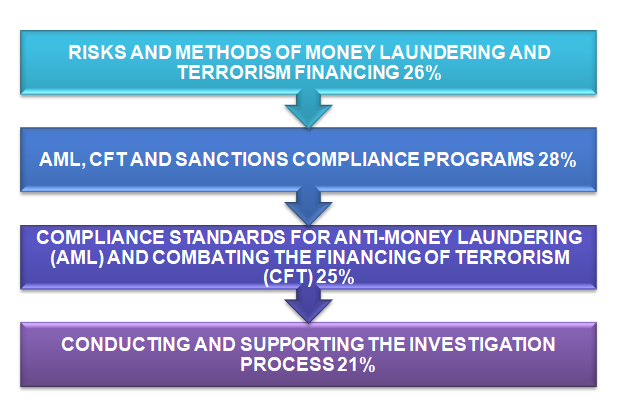

As promised, we’ll now talk about the CAMS certification exam’s course plan. This will assist you in properly structuring your preparation. Furthermore, when topics are broken into several subsections, it becomes much easier for you to study for the same. So, let’s get started right now.

Chapter1: RISKS AND METHODS OF MONEY LAUNDERING AND TERRORISM FINANCING 26%

- Firstly, what is money laundering?

- Secondly, three stages in the money laundering cycle.

- Subsequently, the risk associated with new payment products and services.

- Last but not least, corporate vehicles used to facilitate illicit finance.

Chapter2: AML, CFT AND SANCTIONS COMPLIANCE PROGRAMS 28%

- Financial Action Task Force (FATF).

Chapter3: COMPLIANCE STANDARDS FOR ANTI-MONEY LAUNDERING (AML) AND COMBATING THE FINANCING OF TERRORISM (CFT) 25%

- Firstly, assessing AML/CFT Risk.

- Subsequently, AML/CFT Program.

Chapter4: CONDUCTING AND SUPPORTING THE INVESTIGATION PROCESS 21%

- First of all, investigations initiated by the financial institution.

- Subsequently, AML/CFT Cooperation between Countries.

This sums up the whole course outline for the CAMS certification. But, if you still have any query, CLICK HERE.

Use the CAMs Cheat Sheet to get better understanding of the Exam!

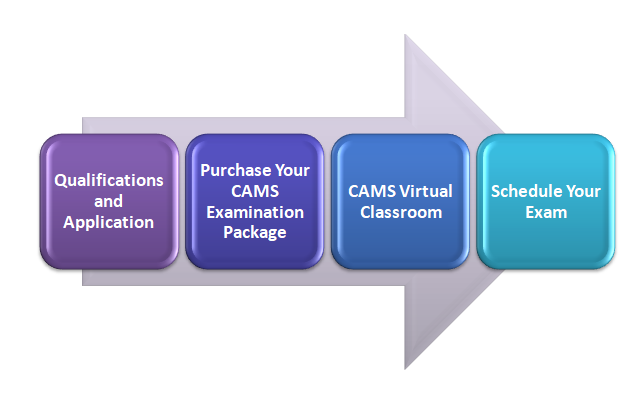

Fast Forward 4 to begin the CAMS Certification Process

The CAMS Certification will help you redefine your compliance career and increase your value to companies. So, to begin your certification process, we propose that you follow the steps below. Let’s get start with the first step, which will determine your eligibility and then begin the process-

1. Qualifications and Application

- First thing first, visit our eligibility calculator to discover if you have the requisite qualifications to appear for the CAMS exam.

- Now, submit your application through the new user-friendly online web form.

- And, if you still can’t figure out the step properly, download the candidate handbook. Also, note that because of GDPR compliance, ACAMS is no longer accepting paper applications or in PDF format.

2. Purchase Your CAMS Examination Package

Don’t forget that the CAMS Examination Package comprises of the CAMS Study Guide. Further, this becomes the most valuable tool in preparation for the exam

| Public Sector | Private Sector |

| USD $1,295 | USD $1,695.00 |

3. CAMS Virtual Classroom

This is the most important section of any preparation handbook. As a result, ACAMS also delivers the CAMS Virtual Classroom to the candidates. This package includes six 2-hour web-based programs that will help you structure and deepen your preparation. For more information, CLICK HERE.

4. Schedule Your Exam

Finally, we’ve arrived at the last stage, which is to schedule the examination. You will receive a payment receipt after making your payment, and your application will then be approve. You will also be given an ID number and instructions on how to book your assessment. Furthermore, testing centres are located in hundreds of locations around the world, allowing you to book appointments at your leisure. And, if you wish to find available test centres, CLICK HERE.

How to become a Certified Anti-Money Laundering Specialist?

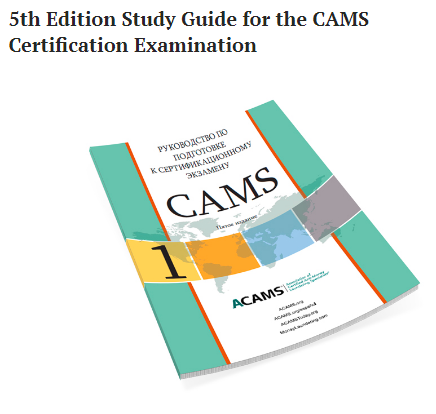

We understand that studying can be challenging at times. But if you follow the guidelines provided in this section, you’ll discover that preparation becomes more manageable. Similarly, the Study Guide might seem like a lot to go through. Yet, if you divide it into smaller parts and start practicing, you’ll become proficient in the course material quickly. So, let’s start with this study guide, one step at a time.

First thing first, understand that the Certified Anti-Money Laundering Specialist (CAMS) Examination Package consists of all the resources required to take the CAMS Exam in confidence.

The CAMS Exam Study Guide

The study guide for the Certified Anti-Money Laundering Specialist is your primary resource for getting ready for the exam. This guide will guide you through:

- Firstly, money laundering risks and methods, specifically the Black Market Peso Exchange and import and export price manipulation.

- Next thing, the Financial Action Task Force (FATF), the Basel Committee’s Report on Customer Due Diligence and the Wolfsberg Group Principles also.

- Subsequently, this includes important elements of an Anti-Money Laundering (AML) program.

- Last but not least, how to initiate and sustain a money-laundering investigation.

Glossary

Here are some terms and concepts related to ACAMS certification:

- Anti-Money Laundering (AML): A group of rules, laws, and steps made to stop and uncover the illegal moving and hiding of money gained from criminal actions.

- Financial Crimes Enforcement Network (FinCEN): A bureau of the United States Department of the Treasury that is responsible for administering the Bank Secrecy Act (BSA) and other AML regulations.

- Know Your Customer (KYC): A method of confirming who a customer is and evaluating how risky they might be, all to stop money laundering and similar financial crimes.

- Suspicious Activity Report (SAR): A report that banks and financial institutions need to send to FinCEN if they think a transaction could be connected to money laundering or other illegal actions.

- Certified Anti-Money Laundering Specialist (CAMS): A professional certification offered by ACAMS that demonstrates knowledge and expertise in AML regulations, compliance, and best practices.

- Certified Global Sanctions Specialist (CGSS): A professional certification offered by ACAMS that focuses on global sanctions regulations and compliance.

- Certified Financial Crime Specialist (CFCS): A certification provided by ACAMS that covers various financial crimes, like money laundering, fraud, and terrorist financing.

- Due Diligence: Investigating a person or company before starting a business relationship to understand potential risks and follow AML rules.

- Risk Assessment: A process of evaluating the likelihood and potential impact of risks related to AML and other financial crimes, and developing strategies to mitigate those risks.

- Compliance Program: A set of policies, procedures, and controls implemented by financial institutions to ensure compliance with AML regulations and prevent financial crimes.

Study Flashcards

Test your cognition of the CAMS exam with the help of quiz-style printable flashcards. These study flashcards highlight the most important learning elements from the CAMS study guide while also assessing the candidate’s understanding of the material.

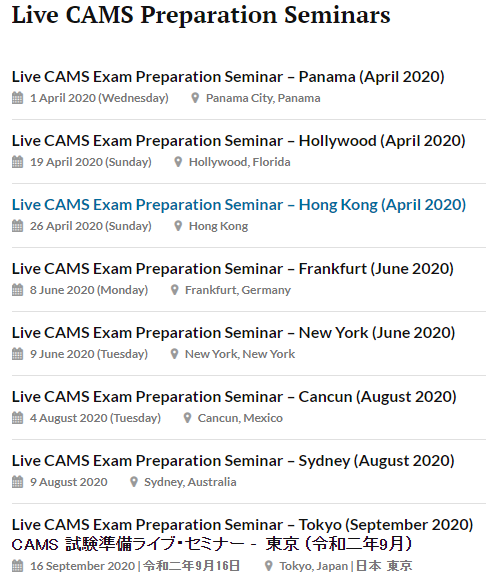

Live CAMS Preparation Seminars

These live seminars can help the candidate with their preparation. So, don’t forget to check them out.

Now that you’re confident in your preparation, let’s go on to the next step. As a result, ensure that you have a thorough understanding of AML. Through this, you will be able to create strong relationships that will aid you in passing the exam. As well as assisting you in your career as an AML professional. We all get the benefits of our own work in the end.

Value of CAMS Certification in 2025

| Category | Without CAMS Certification | With CAMS Certification |

|---|---|---|

| Average Salary (Global) | $55,000 – $75,000 USD/year | $90,000 – $125,000 USD/year |

| Job Roles Accessible | Entry-level compliance, Analyst | AML Officer, Compliance Manager, FIU Analyst |

| Promotion Opportunities | Slower, experience-driven | Faster with credential-based advancement |

| Recruiter Preference | Moderate | High – CAMS often listed as job requirement |

| Global Recognition | Limited to local firms | Recognized in 190+ countries |

| Professional Network Access | Limited | ACAMS network: 90,000+ professionals |

| Access to Training & CPE | Generic or company-dependent | Exclusive webinars, whitepapers, journals |

| Work Opportunities Abroad | Limited | Expanded options in international markets |

Did You Know?

- In a 2024 approximately 68% of CAMS-certified professionals reported salary increases within 12 months of certification.

- Over 90% of global financial institutions recognize or require CAMS certification for senior compliance roles.

Final Words

CAMS is the only certification available for anti-money laundering specialists. Candidates improve their understanding, build their skills, and achieve the competencies needed to effectively secure enterprises and deter crime by studying for and passing the CAMS exam. Obtaining this certificate also demonstrates your dedication to your field and the development of your professional skills. Furthermore, the CAMS accreditation keeps anti-money laundering experts up to date on current industry trends. Most significantly, it shows that the owners are committed to preventing money laundering. Lastly, from a career point of view, the CAMS certification also offers better job possibilities and greater salaries.

A great career is just a certification away. So, practice and validate your skills to become a Certified Anti-Money Laundering Specialist.